A GSA Schedule Contract is an unfunded agreement that allows the government to purchase goods or services from a vendor at a pre-specified price. The term "unfunded" indicates there is no guarantee the vendor will secure a sale under the contract. However, a GSA Schedule Contract adheres to Federal Acquisition Regulations (FAR), enabling government buyers to procure goods through the schedule system, bypassing more cumbersome government procurement processes.

A GSA Schedule Contract simplifies the federal procurement process, providing federal buyers with a less complex purchasing avenue. This preference drives federal buyers to utilize the Multiple Award Schedule (MAS) of the General Services Administration (GSA), presenting unique selling opportunities for GSA Schedule Contract holders. This system is widely favored among federal buyers for its efficiency and streamlined procedures.

The first question many people ask when pursuing a GSA Schedule contract is “Do I need to use GSA consultants?” The answer to this question comes in various forms but the reality is “it depends.” If the individual completing the application has competency in completing government proposals, is willing to put in some work in to understand what at times can be an ambiguous process, and follows these steps, it is possible to complete a GSA contract on your own or with the assistance of a GSA service provider.

To qualify for a GSA Schedule Contract under the MAS program, the firm must meet the following criteria:

Additionally, the requirement of having 2 years of business history no longer applies. The Springboard program is now available to all businesses, including those less than 2 years old, seeking to enter the GSA Schedule Contract program.

To successfully market to government agencies through GSA, follow these essential steps:

Obtaining a GSA Schedule can significantly enhance your firm's ability to penetrate the lucrative federal marketplace, utilizing GSA contracts and GSA Advantage for continued success.

Many small businesses aim for SBA Certification or VA Verification but often overlook the potential benefits of obtaining a GSA Schedule Contract. Certification holders that are eligible should “get a GSA Supply Contract” and the following case will demonstrate why it is in the best interest of the firm.

Many small businesses aim for SBA Certification or VA Verification but often overlook the potential benefits of obtaining a GSA Schedule Contract. Certification holders that are eligible should “get a GSA Supply Contract” and the following case will demonstrate why it is in the best interest of the firm.

The GSA Multiple Award Schedule (MAS) system encompasses a wide range of industries and products, catering to diverse needs within the federal government procurement space. Here are some key industry categories and products featured on the GSA Award System:

Among service industries, IT and Professional Services dominate the GSA schedule. These sectors are crucial for providing technological solutions, consulting services, and specialized expertise to government agencies. Additionally, industries such as facilities maintenance, logistics, travel services, security, and janitorial services also maintain a robust presence.

The GSA MAS Schedule lists millions of products, offering a comprehensive array that includes:

Obtaining a GSA Schedule can significantly enhance your firm's ability to penetrate the lucrative federal marketplace, utilizing GSA contracts and GSA Advantage for continued success.

It's important to note that certain industry sectors are not typically found on GSA Contracts due to federal regulations. Specifically, architecture firms are excluded from the GSA schedule by federal law. Similarly, general contractors for building construction projects are also not included in the GSA scheduling system.

Understanding these industry types and limitations helps businesses tailor their approach when pursuing opportunities within the GSA procurement framework. By aligning with eligible industries and products, businesses can effectively leverage the GSA MAS Schedule to access federal contracting opportunities.

When a firm seeks a contract, it submits a proposal to the General Services Administration (GSA) following a specific format. This process is often considered rigorous and can span several months to complete. The GSA evaluates several key aspects to determine if the firm is capable of successfully fulfilling a federal contract. These assessments include:

Once the GSA is prepared to approve the proposal, they engage in final price negotiations with the firm. During this phase, the GSA works to establish fair and reasonable pricing terms within the contract

Once a contractor's GSA contract is awarded following a successful eOffer submission, their pricing catalog is uploaded to both GSA eLibrary and GSAAdvantage.gov. GSA eLibrary provides federal contracting officers with comprehensive visibility into the offerings of individual companies. Meanwhile, GSA Advantage functions as an e-commerce platform where government buyers can compare products and make purchases with ease.

Additionally, GSA Contract holders gain access to GSA eBuy, an exclusive platform where special bidding opportunities are posted, accessible only to GSA Contract holders.

Federal buyers typically need to evaluate and document offerings from at least three vendors to make a best-value decision. Utilizing platforms such as GSA eLibrary, GSA Advantage, and GSA eBuy simplifies the process for federal buyers to meet this FAR requirement during their purchasing process.

A GSA Federal Contract is initially awarded for a five-year period with the option for renewal up to three times, each for an additional five years, allowing for a maximum contract duration of up to 20 years. Modifications to the contract can be made throughout its lifespan to accommodate evolving needs and requirements.

As of 2023, there are between 19,000 and 20,000 businesses holding GSA Schedule Contracts, collectively listing over 7 million products and services on the GSA Schedule System. Approximately three-quarters of these businesses holding GSA Contracts are classified as small businesses.

The Federal Supply System represents about 15% of federal discretionary spending. Small businesses, on average, achieve around $1 million per year in federal sales, whereas large businesses can secure over $100 million annually through contract sales.

For many small businesses, obtaining a GSA Schedule Contract serves as a pivotal opportunity to secure their first contract within a federal agency. Successful performance often streamlines the process of winning future contracts.

A GSA MAS Schedule Contract serves as a vital contracting vehicle that facilitates easy and compliant transactions between sellers and federal buyers. Here are the key benefits:

Firms with a GSA MAS Schedule Contract tend to achieve greater success in selling to the federal government compared to their peers. On average, small businesses with a GSA Schedule Contract generate over $1 million per year in sales from the Schedule alone.

Qualifying Criteria for a GSA MAS Contract

To have a proposal accepted by the General Services Administration (GSA) for a GSA MAS Contract, firms must meet several key criteria:

Your products or services must align with an existing GSA MAS contract. The GSA utilizes the scheduling system for routine and repetitive purchases, aiming to ensure cost-effectiveness. While there are over 8 million products and thousands of services listed on GSA Schedules, certain novel products or large categories like architecture and general contracting are excluded due to federal acquisition regulations.

The GSA MAS Schedule system prioritizes reliability and quality for government purchases. Therefore, firms must demonstrate financial stability to maintain the integrity of the system. The GSA scrutinizes firms with any of the following financial issues:

Goods offered on a GSA MAS Contract must be commercially available. The GSA verifies this by reviewing past invoices to ensure consistency between the prices offered to the government and those in the commercial marketplace. Typically, the GSA prefers firms with at least three customers and a minimum of $25,000 in sales.

Firms must provide consistent pricing year-round for their products. This requirement ensures predictability for government buyers, although it may pose challenges for commodities with volatile market prices, like coffee.

Both the company and its principal owners/managers must exhibit high moral character. Specifically, they must not have been disbarred from federal government business within the last three years, nor have civil or criminal convictions related to performance on federal, state, or local contracts.

GSA is a great place for federal buyers to conduct market research. The GSA Schedule system allows federal buyers to purchase from the correct company status because companies with an SBA designation are indicated by having the following letters associated with their firm.

| Indicator | Company Status |

|---|---|

| S | Small Business |

| o | Other than Small Business |

| w | Women-Owned Business |

| v | Veteran-Owned Small Business |

| dv | Service Disable Veteran-Owned Small Business |

| d | SBA Certified Small Disadvantage Business |

| 8as | 8(a) Sole Source Pool |

| 8a | SBA Certified 8(a) Firm (used as 8(a) competitive pool) |

| h | SBA Certified HUBZone Firm |

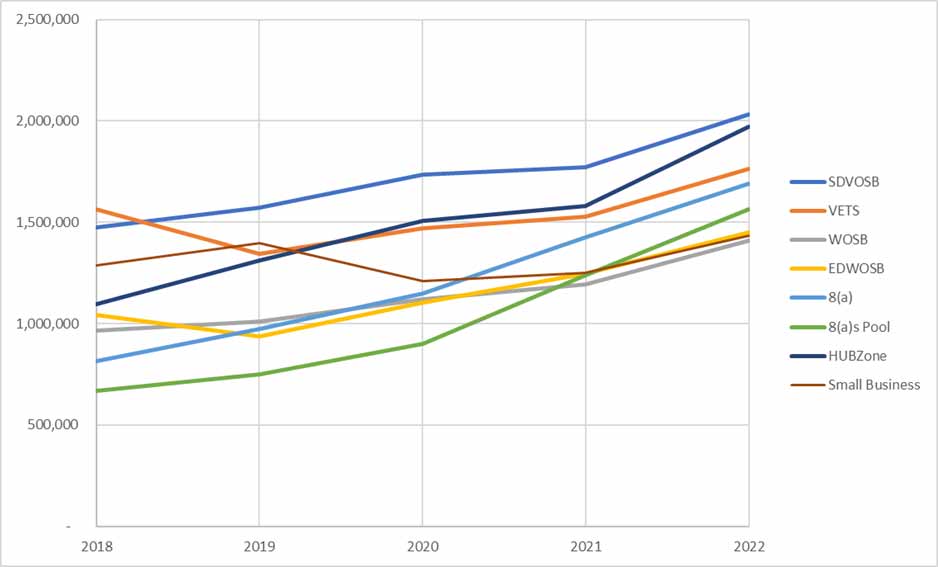

The following graph shows that all SBA Certification types have increased their GSA Sales over the past 5 years. Over the last five years, the average GSA Sales have increased from $1,058,000 to $1,665,000.

The GSA Schedule plays a crucial role in federal procurement, as evidenced by the following data:

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 11,055 | 14,246,000,000 | 1,288,648 |

| 2019 | 11,120 | 15,516,000,000 | 1,395,324 |

| 2020 | 11,068 | 13,392,000,000 | 1,209,975 |

| 2021 | 11,375 | 14,243,000,000 | 1,252,132 |

| 2022 | 11,722 | 16,821,000,000 | 1,423,994 |

GSA Schedules are often used by small businesses to boost their federal sales. Small businesses that go through this process are rewarded with an average of $1MM in annual sales through their GSA Contract.

Small businesses that have a special designation generally achieve even better results than the small business average. The numbers show that getting a GSA Schedule and combining it with an SBA designation increases the effectiveness of GSA Scheduled Contracts. (See table below)

| Business Type/Size | Amount of GSA Revenue | # of GSA Schedule Holders | Average GSA Revenue 2020 |

|---|---|---|---|

| Large Business | 28.0B | 2,221 | 13,328,681 |

| Small Business | 16.8B | 11,722 | 1,434,994 |

| SDVOSB | 3.2B | 1,570 | 2,032,484 |

| VOSB | 4.0B | 2,287 | 1,762,702 |

| EDWOSB | 2.4B | 1,665 | 1,451,051 |

| WOSB | 4.7B | 3,368 | 1,407,363 |

| 8a | 2.1B | 1,248 | 1,691,506 |

| 8(a)s | 1.1B | 690 | 1,565,652 |

| HUBZone | 1.7B | 860 | 1,970,000 |

If we break these groups into Industries, we can see where the GSA + Certification/Verification provides the most benefits to firms.

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 1,046 | 852,000,000 | 814,532 |

| 2019 | 1,046 | 1,034,000,000 | 971,805 |

| 2020 | 1,095 | 1,257,000,000 | 1,147,945 |

| 2021 | 1,166 | 1,663,700,000 | 1,426,844 |

| 2022 | 1,284 | 2,111,000,000 | 1,691,506 |

Best Performing Industries

| Industry | 8(a) Certification Sales | # Vendors | Average Sales |

|---|---|---|---|

| Clothing, Textiles & Subsistence S&E | 7,121,576 | 11 | 647,416 |

| Electronic & Communication Equipment | 19,340 | 2 | 9,670 |

| Equipment Related Services | 9,955 | 1 | 9,955 |

| Facilities & Construction | 100,158,108 | 115 | 870,940 |

| Human Capital | 59,526,013 | 61 | 975,836 |

| Industrial Products & Services | 93,841,976 | 64 | 1,466,281 |

| IT | 1,354,451,159 | 974 | 1,390,607 |

| Miscellaneous S&E | 3,781,814 | 8 | 472,727 |

| Office Management | 48,196,380 | 68 | 708,770 |

| Professional Services | 629,988,143 | 459 | 1,372,523 |

| Security and Protection | 108,750,479 | 29 | 3,750,017 |

| Sustainment S&E | 2,082,512 | 6 | 347,085 |

| Transportation and Logistics Services | 23,607,685 | 43 | 549,016 |

| Travel & Lodging | 87,983 | 2 | 43,992 |

| Totals | 2,431,623,123 | 1,633 | 1,489,053 |

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 1255 | 1,848,000,000 | 1,472,510 |

| 2019 | 1,367 | 2,148,000,000 | 1,571,324 |

| 2020 | 1,388 | 2,411,000,000 | 1,737,032 |

| 2021 | 1,455 | 2,578,000,000 | 1,771,821 |

| 2022 | 1,570 | 3,191,000,000 | 2,032,484 |

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 2,039 | 3,190,500,000 | 1,564,738 |

| 2019 | 2,110 | 2,839,300,000 | 1,345,640 |

| 2020 | 2,089 | 3,068,700,000 | 1,468,980 |

| 2021 | 2,167 | 3,311,200,000 | 1,528,011 |

| 2022 | 2,287 | 4,031,300,000 | 1,762,702 |

| Industry | SDVOSB Sales | # Vendors | Average Sales |

|---|---|---|---|

| Clothing, Textiles & Subsistence S&E | 27,746,813 | 25 | 1,109,873 |

| Electronic & Communication Equipment | 10,996,966 | 7 | 1,570,995 |

| Equipment Related Services | 6,820,581 | 2 | 3,410,291 |

| Facilities & Construction | 55,501,198 | 89 | 623,609 |

| Human Capital | 130,384,182 | 109 | 1,196,185 |

| Industrial Products & Services | 185,691,604 | 100 | 1,856,916 |

| IT | 1,092,294,331 | 652 | 1,675,298 |

| Medical | 1,791,950 | 9 | 199,106 |

| Miscellaneous S&E | 7,301,048 | 16 | 456,316 |

| Office Management | 87,204,104 | 78 | 1,118,001 |

| Professional Services | 593,686,794 | 447 | 1,328,158 |

| Security and Protection | 51,905,312 | 31 | 1,674,365 |

| Sustainment S&E | 2,562,551 | 18 | 142,364 |

| Transportation and Logistics Services | 80,163,343 | 63 | 1,272,434 |

| Travel & Lodging | 10,859,168 | 11 | 987,197 |

| Totals | 2,344,909,945 | 1,657 | 1,415,154 |

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 3,161 | 3,051,000,000 | 965,201 |

| 2019 | 3,185 | 3,212,000,000 | 1,008,477 |

| 2020 | 3,186 | 3,569,000,000 | 1,120,213 |

| 2021 | 3,272 | 3,906,000,000 | 1,193,765 |

| 2022 | 3,368 | 4,740,000,000 | 1,407,363 |

| Federal Fiscal Year | # of GSA Firms | Total GSA Sales | Avegare Sales |

|---|---|---|---|

| 2018 | 1,313 | 1,371,100,000 | 1,044,250 |

| 2019 | 1,313 | 1,371,100,000 | 1,044,250 |

| 2020 | 1,478 | 1,632,000,000 | 1,104,195 |

| 2021 | 1,559 | 1,944,000,000 | 1,246,953 |

| 2022 | 1,665 | 2,416,000,000 | 1,451,051 |

| Industry | WOSB Sales | # Vendors | Average Sales |

|---|---|---|---|

| Clothing, Textiles & Subsistence S&E | 38,461,326 | 91 | 422,652 |

| Electronic & Communication Equipment | 893,412 | 13 | 68 |

| Equipment Related Services | 1,218,837 | 12 | 101,570 |

| Facilities & Construction | 99,209,735 | 265 | 374,376 |

| Human Capital | 114,274,831 | 176 | 649,289 |

| Industrial Products & Services | 253,245,892 | 221 | 1,145,909 |

| IT | 1,719,390,363 | 1,272 | 1,351,722 |

| Medical | 894,283 | 6 | 149,047 |

| Miscellaneous S&E | 10,113,126 | 60 | 168,552 |

| Office Management | 164,443,221 | 274 | 600,158 |

| Professional Services | 1,066,351,977 | 1,105 | 965,024 |

| Security and Protection | 74,527,967 | 49 | 1,520,979 |

| Sustainment S&E | 8,882,995 | 52 | 170,827 |

| Transportation and Logistics Services | 74,664,599 | 107 | 697,800 |

| Travel & Lodging | 5,338,898 | 22 | 242,677 |

| Totals | 3,631,911,462 | 3,401 | 1,067,895 |

A GSA Schedule Contract is an indefinite-delivery, indefinite-quantity (IDIQ) contract that falls under the GSA’s Multiple Award System (MAS). The purpose of GSA Schedule Contract is to eliminate paperwork and bureaucracy, assisting federal procurement employees in purchasing products and services at pre-negotiated prices and terms.

Approximately 14,400 firms have a GSA MAS Contract. There are approximately 12,000 small businesses and 2,400 large businesses with GSA Federal Contracts.

Approximately 11 million different goods and services.

Generally a GSA Contract remains in place for a five year period. It can be renewed three times for twenty years total in contract life.

There are several factors that determine the amount of time it takes to obtain a GSA MAS Contract. Once you have submitted all required documents for approval to the GSA. Then the GSA schedule goes through a multi-step approval process. Review times range from three to five months. There is an expedited process if the GSA federal supply is initiated through a federal agency request, which is approximately four weeks.

Yes – Firms with an 8(a) Certification, HUBZone, WOSB, EDWOSB, SDVOSB, or Veteran Owned certification have this listed on their GSA Advantage and GSA eLibrary listings.

Generally a firm applying for a GSA Contracts must have had at least 25,000 in sales over the prior two years in the industry in which they are seeking the GSA Contract.

There is no one-size-fits-all answer to this, as the performance largely depends on the market dynamics and federal demand. However, data suggests that IT and Professional Services are the dominant players. Specifically, 35% of 8(a) firms are in the Information Technology sector, while 30% operate within Professional Services. Both of these industries tend to do well within the federal 8(a) space; however, many niche industries out-preform these more mainstream industries.

A GSA Multiple Award Schedule can greatly enhance an 8(a) firm in the marketing of its goods and services. This is because Schedule contracts are the predominant method of purchasing most federal procurement officers choose, in order to do market research. Past studies have shown that 8(a) certified firms achieve 3 times the amount of business than a non-8(a) firm, showing the advantage of the combination.

eBuy is an online procurement tool only for GSA Contract holders that is used by procurement officers to facilitate the request for quotes on proposals for products and services by federal buyers. The average eBuy procurement is sent to seven GSA Schedule holders of which between three and four respond.

State and local governments have the use of GSA Schedules through two platforms: The Cooperative Purchasing and Disaster Recovery Purchasing Programs. State and local government use of GSA Contracts has been a high growth area for the GSA in recent years.

83% of firms with GSA MAS are small business and 37% of GSA revenue is with small business.

A GSA CTA (Contractor Teaming Arrangement) is an agreement combining the goods and services of two or more GSA Contract Holders into one offering. The agreement sets the outline of the roles of each of the firms in the agreement.